Employee vs. Subcontractor

Employee vs. Subcontractor: A Strategic Guide for the Growing Small Business

Scaling a business is a major milestone, but it quickly introduces one of the most complex hurdles in federal tax and labor law: worker classification.

Whether you are a tech startup in Austin, a boutique agency in New York, or a service provider in the Midwest, the decision to hire an employee versus a subcontractor is about more than just a paycheck. It’s a decision that impacts your tax liability, legal exposure, and long-term scalability.

At GP Accounting, LLC, we partner with small businesses nationwide to ensure their growth is built on a compliant and tax-efficient foundation. Here is what every business owner needs to know about the 2026 landscape of worker classification.

The "Control" Factor: Who’s Really in Charge?

The IRS and the Department of Labor (DOL) use specific tests to determine if a worker is a W-2 employee or a 1099 subcontractor. The "touchstone" of this determination is the level of control you exert.

- The W-2 Employee: You have the right to control not only what is done but how it is done. This includes setting specific hours, providing tools and software, and giving detailed instructions on the workflow.

- The 1099 Subcontractor: You control the final result, but the worker determines the "means and methods." True subcontractors are independent business owners; they use their own equipment, set their own schedules, and often serve multiple clients.

The Financial Ripple Effect

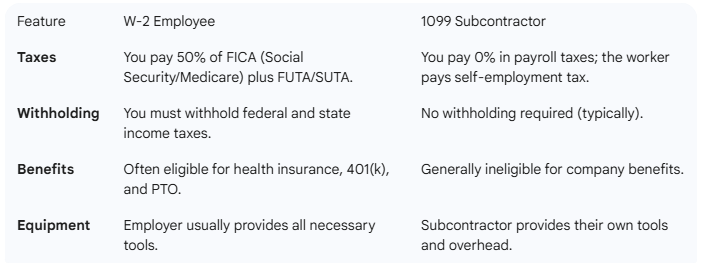

The classification you choose triggers vastly different financial obligations for your business:

Why "Getting it Wrong" is a National Risk

Misclassification is a hot-button issue for federal agencies. In 2026, the Department of Labor has returned to a more flexible "Economic Reality" test, but the stakes remain high. If the IRS determines your subcontractors should have been employees, you could be liable for:

- Unpaid employer-side payroll taxes for all years the worker was active.

- Back-pay for overtime and minimum wage violations under the Fair Labor Standards Act (FLSA).

- Hefty interest and "failure to file" penalties that can quickly reach six figures.

Strategic Advice for 2026

As an accounting firm with an MBA perspective, we look beyond the tax forms. If you are hiring for a core business function—something your company does every day—the IRS almost always expects that person to be an employee. If you are hiring for a specialized, temporary project (like a website redesign or a one-time marketing campaign), a subcontractor is usually the right strategic move.

TIP: Always have a signed independent contractor agreement on file before work begins.

How GP Accounting, LLC Supports Your Growth

Managing a nationwide team requires a firm that understands federal compliance and the nuances of the modern, remote workforce. We help you:

- Audit current classifications to identify and mitigate audit risks.

- Optimize your payroll strategy to balance cost-savings with legal safety.

- Streamline 1099 and W-2 filings so you never miss a deadline.

Ready to grow your team the right way? Don't let a classification error stall your momentum. Click here to schedule a consultation and let’s ensure your small business is protected and prepared for the future.

Main Topic Hub: Independent Contractor (Self-Employed) or Employee?

Behavioral & Financial Control Details: Worker Classification 101

Official Publication (PDF):

IRS Publication 1779: Independent Contractor or Employee