Creating Business Entity and Getting an EIN

Your Launch Checklist: Creating Your Business Entity & Getting Your EIN (California Edition)

Starting a new venture is one of the most exciting things you can do. You have the idea, the drive, and the business plan. Now, it's time for the legal groundwork: establishing your business entity and securing your federal Employer Identification Number (EIN).This guide walks you through these essential steps, using the Limited Liability Company (LLC) as the primary example in the state of California.

Disclaimer: The following information is for general guidance only and is not legal or tax advice.

1. Choose Your Business Structure

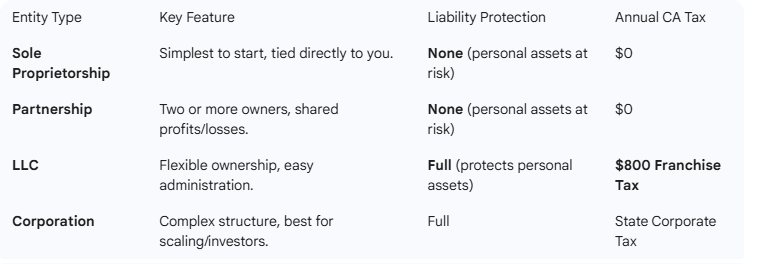

Your choice of structure dictates your liability, taxes, and paperwork. While options exist (Sole Proprietorship, Partnership, Corporation), the Limited Liability Company (LLC) is the most popular choice for small business owners because it separates your personal assets from the business's debts.

For maximum flexibility and asset protection, the LLC is typically the way to go.

2. Register Your LLC with the State of California

The official formation process takes place through the California Secretary of State (SOS).

A. Name Check and Reservation

Before spending time on paperwork, search the SOS business name database to ensure your desired name is available. Your legal business name must include "Limited Liability Company" or "LLC" (or a valid abbreviation).

B. Appoint a Registered Agent

A Registered Agent (or Agent for Service of Process) is an individual or company designated to receive official legal and tax documents on your LLC’s behalf. This agent must have a physical street address in California and be available during business hours. You can often appoint yourself.

C. File the Articles of Organization

- Form: File Form LLC-1, Articles of Organization.

- Where: Submit this form online via the SOS's website for the fastest processing.

- Filing Fee: The one-time state filing fee is $70.

- Result: Once approved, your LLC is officially formed and legally recognized in California.

D. File the Initial Statement of Information

- Form: File Form LLC-12, Initial Statement of Information.

- When: This is due within 90 days of filing the Articles of Organization, and then every two years thereafter.

- Filing Fee: $20.

3. Secure Your Federal EIN (Employer Identification Number)

Your EIN is your business’s unique tax identification number, essentially its Social Security Number (SSN).

A. Who Needs an EIN?

If your LLC has more than one member (Multi-Member LLC) or if you plan to hire employees, an EIN is mandatory.

Crucially, even if you are a Single-Member LLC, you will still need an EIN to:

- Open a business bank account.

- Elect to be taxed as an S-Corporation or C-Corporation.

- File various business tax returns.

B. The Simple IRS Application Process

- Where to Apply: You must apply directly through the IRS website.

- Cost: The application is free. Avoid third-party sites that charge for this service.

- Timing: The online process is quick; your EIN is typically issued immediately upon completion.

- What you need: The name and address of your LLC and the SSN or ITIN of the person responsible for the business (the Responsible Party).

4. The Mandatory California LLC Operating Agreement

Even if you are the only owner (Single-Member LLC), California law requires all LLCs to maintain a written Operating Agreement (California Corporations Code 17701.02.

Why is the Operating Agreement So Important?

A. Protects Your Limited Liability: It proves the legal separation between you and your business—the key defense against piercing the corporate veil in a lawsuit.

B. Overrides State Default Rules: Without one, your LLC is governed by California's default LLC laws, which may not align with your business goals, particularly regarding dissolution or ownership transfer.

C. Governance (Even for One Person): It sets out your ownership percentage, the business's purpose, the initial capital contributions, and the process for adding members or handling a sale.

Note: The Operating Agreement is an internal document and is not filed with the California Secretary of State. Keep it safely with your other essential business records.

5. Address California State Taxes and Local Permits

Your legal work isn't quite done until you satisfy California's tax and local requirements.

A. The $800 Annual Minimum Franchise Tax

All California LLCs must pay a $800 minimum franchise tax to the Franchise Tax Board (FTB) every year, regardless of income. Additional fees apply if the LLC's total income exceeds $250,000.

B. Seller's Permit (Sales Tax)

If your business will sell or lease tangible personal property (physical goods), you must register for a Seller's Permit with the California Department of Tax and Fee Administration (CDTFA). This allows you to collect sales tax from your customers.

C. Local Business License (City/County)

Most cities and counties require every business, regardless of size, to obtain a local business license or permit before operating. Check the local government website for your city/county of operation.

Your Next Steps for Success

Congratulations! You have established your legal identity (the LLC) and your tax identity (the EIN). You are officially ready to operate. Your next steps should include:

- Open a dedicated business bank account using your Articles of Organization and EIN.

- Set up a simple bookkeeping system to track revenue and expenses.

- Draft, sign, and store your Operating Agreement.