Kingsland GA 1099 Rules: Deadlines & NEC vs. MISC Explained | GP Accounting LLC

The New 1099 Rules: What Kingsland Business Owners Need to Know

As a small business owner here in Kingsland, GA, you wear many hats—but "IRS Compliance Expert" shouldn't have to be one of them. With the end of the year approaching, your focus should be on wrapping up projects and planning for growth, not panicking over tax paperwork. Yet, there is one crucial area where a simple mistake can lead to surprisingly steep penalties: Form 1099.

If your business paid $600 or more to any independent contractor, consultant, or freelancer this year, you are required to file this form. But knowing which 1099 form to use and meeting the strict deadlines is where most local businesses trip up. This guide breaks down the essential 1099 rules for 2025 and shows you exactly how to avoid those frustrating, unnecessary IRS fines, keeping your cash flow healthy and your business compliant.

1. 1099-NEC vs. 1099-MISC: The Critical Difference

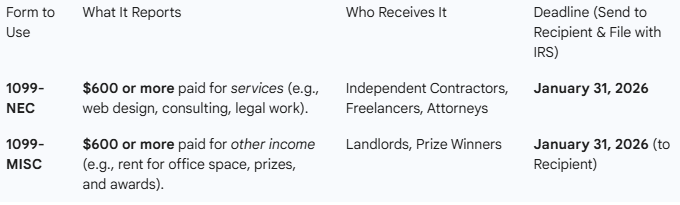

The single biggest source of confusion is knowing which form to use. The IRS brought back Form 1099-NEC (Nonemployee Compensation) specifically to track contractor payments and separate them from other types of miscellaneous income.

Key Takeaway: If you hired a local plumber to fix your office pipes, they get a 1099-NEC (for services). If you pay the monthly lease on your retail space, the landlord gets a 1099-MISC (for rent).

2. The Must-Know Deadline for the 2025 Tax Year

The most important date to remember for your most common 1099 form is January 31, 2026.

The filing deadlines for the 1099-NEC are notoriously strict because the IRS wants to match contractor income as quickly as possible. Unlike some other forms, there is no automatic 30-day extension for the 1099-NEC.

- Deadline: All copies of the 1099-NEC must be furnished to the recipient and filed with the IRS by January 31, 2026.

The Penalty Trap

Penalties for late or incorrect filing of information returns can range from $60 to over $600 per form, depending on how late you file. If the IRS determines you intentionally disregarded the requirement, the penalty can jump to $660 per form or more, with no maximum. For a small Kingsland business, these fines can be crippling.

3. The Only Way to Guarantee Compliance: Collect the W-9

The secret to a stress-free January lies in one simple form: IRS Form W-9.

The W-9 collects the contractor's legal name, address, business classification (e.g., LLC, sole proprietor, corporation), and the all-important Taxpayer Identification Number (TIN/SSN). Without the correct information, you cannot file a compliant 1099.

Best Practice for Kingsland Businesses:

- Collect the W-9 on Day One: Make collecting a signed W-9 part of your onboarding process for every new contractor—before you issue their first payment. Don't wait until year-end when you'll be scrambling.

- The Corporation Exception: Generally, you do not need to issue a 1099-NEC to payments made to an S Corporation or C Corporation. However, it's always best practice to collect the W-9 upfront, as this form tells you exactly how the business is classified.

- Store Securely: W-9s contain sensitive information. Keep them in a secure, digital location. Do not send W-9s to the IRS—they are for your records only.

Ready to Simplify Your Tax Compliance?

Dealing with the intricacies of W-9 collection, 1099 form selection, and the constantly moving deadlines is complicated. As an accounting firm with expertise in both finance and business advisory, GP Accounting, LLC can manage this entire process for you. We ensure your contractors are correctly classified and all forms are filed on time, every time.

Stop worrying about penalties and start planning for growth. Contact GP Accounting, LLC today for a free consultation to review your contractor setup before the tax deadline.